Today, Russia is hosting a summit of the BRICs, the emerging markets that seem to have only one thing in common, namely to have been lumped together by Goldman Sachs in 2001. The countries will discuss the global financial architecture and their role in it. There’s lots of talk about them in the media. Let me pick up on two articles published in Business New Europe today (subscription required), of which some abstracts below.

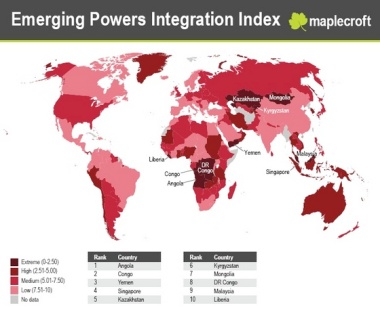

A first article reports on a map that was just developed of the actual global integration (investment, trade and migration) of the BRICs with the rest of the world:

“Consulting company Maplecroft has just produced the Emerging Powers Integration Index (EPII), which tries to go beyond the usual comparisons of GDP growth or trade and assesses just how dependant the rest of the world already is on the BRICs.