If you’re interested in this issue, look here.

Archive for the 'Russia, Ukraine, Eurasia' Category

Should and can the United States fast-track Russian accession to the WTO?

September 18, 2009The Yekaterinburg BRICs and a closer look at their global reach

June 16, 2009Today, Russia is hosting a summit of the BRICs, the emerging markets that seem to have only one thing in common, namely to have been lumped together by Goldman Sachs in 2001. The countries will discuss the global financial architecture and their role in it. There’s lots of talk about them in the media. Let me pick up on two articles published in Business New Europe today (subscription required), of which some abstracts below.

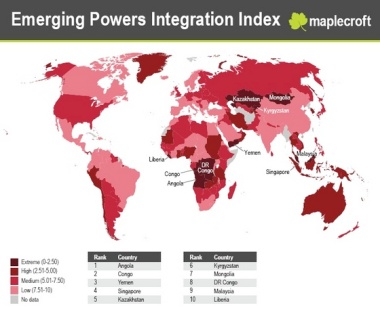

A first article reports on a map that was just developed of the actual global integration (investment, trade and migration) of the BRICs with the rest of the world:

“Consulting company Maplecroft has just produced the Emerging Powers Integration Index (EPII), which tries to go beyond the usual comparisons of GDP growth or trade and assesses just how dependant the rest of the world already is on the BRICs.

A few thoughts on what’s behind the EU’s ineptitude in dealing with the Russian-Ukrainian gas row and with other Russian problems

January 7, 2009The current disruption of gas supplies to Ukraine and therefore to the rest of Europe is unprecedented and its scale is much larger than the first such disruption during a similar dispute on gas prices, Ukrainian debts, and/or transit fees back in 2006. The media is full of these stories. Here is one.

Who’s to blame? Read the rest of this entry »

Quo vadis the authoritarian BRICs in 2009?

December 27, 2008

It is often said that the governments of the big authoritarian states of the day, namely Russia and China, have struck an informal bargain with their population: economic growth and rising income levels delivered at the price of relinquishing political freedoms. As long as China was growing at double-digit levels and Russia surfing on an unprecedented oil boom, this bargain seems to have worked – when one discounts the rising numbers of riots in rural China in the last years. Now that the Credit Crunch is hitting these markets, the big question marks are not only on these countries’ growth rates next year, but more worryingly on their politics. Optimists would say this crisis is an opportunity for political change and democratization. Pessimists would argue that the regimes will cling to power, even if it is at the price of rolling back market-friendly reforms. How will popular discontent be vented? How will the authorities react? These are the big questions for 2009. Some developments are already in the making: Read the rest of this entry »

Sample of a video-audio week-end: US facing its crisis, Russian affairs, Pascal Lamy.

November 23, 2008This blog is written by a nerd-of-sorts who hardly ever watches online videos, is still not quite familiar with YouTube, and loves one means of transmitting information above all others: the written word. This week-end, however, I’ve decided to prioritize listening and watching. A small sample of my audio-video tour:

Aftermath of the Georgia war by Amnesty International: here. (thanks to James over at the Robert Amsterdam blog).

The US debating how to deal with Russia – CNN interview hosted by Fareed Zakaria (thanks again to the Robert Amsterdam blog…)

Howard Rosen from The Peterson Institute in Washington on how to adapt US unemployment benefit schemes to the reality of today’s workforce. Here. To back up this interview with some written text, I do recommend to read Rosen’s latest Policy Brief on the matter.

The US is handling crisis anxiety. Obama unveiled his big plans yesterday. Here. Some more details and background (in written form…;-)) here.

And, for French speakers: Pascal Lamy, the Secretary-General of the WTO, hosting some diplomatic meetings this week-end in Geneva on a potential, highly hypothetical conclusion of a Doha Round deal, spoke to French radio (France Culture) yesterday morning. One of the questions debated was whether global finace could be regulated following a governance model similar to the WTO (oh my….! do we need a financial dispute settlement body?). No answer of course, but a few interesting thoughts tailored to a French audience on the difference between opening markets and regulating markets.

A bit of self-promotion – some work on Russia

November 20, 2008Can something be done about Russia’s tendency to use trade sanctions during political conflicts with its neighbours? Can something be done to avoid that foreign investors in Russia get stripped of their assets? Can the rising tide of trade and protectionism in Russia somehow be halted? Can the EU do something about it, and is it a good idea for Europe to try and discuss a free trade agreement with Russia? Whoever is interested in those kind of questions might want to consider having a look at a new ECIPE paper.

I’ve been examining Russia’s policies for a while and the country’s relations to the EU. This has resulted in a paper, written in collaboration with my colleague Brian Hindley, who has had a closer look at Russia’s WTO accession. For anyone who’s been following my posts on Russian affairs it might be interesting to have a look at it. It has quite an unglamourous title: “Russian Commercial Policies and the European Union – Can Russia be Anchored in a Legal International Economic Order?”. Here is the paper. Ed Lucas, The Economist’s Eastern Europe correspondent who gave a keynote speech at a conference hosted by ECIPE today that was as sensational(ist) as his book on “The New Cold War”, said we should rather have given it the title “We want interdependence, they want a protectionist fence”…. It would have been a more selly title indeed….;-) But in fact it is not that simple: from quotas on Russian steel to cosy national relationships with the Kremlin and a special Gas Monopoly I don’t want to name, there’s a lot of domestic clean-up to be done. My Director Fredrik Erixon recently had some reflections on EU-Russian energy relations, translated, as well, into a new paper. For anybody who’s interested in this issue, it might well be worth having a look at it.

Dealing with Russian gas

November 7, 2008Pierre Noel, from The European Council on Foreign Relations just released a very good paper on how the European Union should deal with Russian gas. It highlights the importance of finalizing the internal market. It says:

The solution to the Russian gas challenge lies not in foreign energy policy but in reform of the European gas market itself. An integrated and competitive European gas market would:

• Create the maximum possible degree of solidarity between European gas consumers.

• Improve collective supply security by allowing the price mechanism to re-allocate physical supply across the entire market in times of supply or demand shocks.

• Make Member States’ bilateral relations with Russia largely irrelevant to the conditions of access to Russian gas for consumers. An integrated market would ‘Europeanise’ bilateral commercial relationships with Gazprom, without the need for political involvement from the EU.

And who’s main responsibility is it? Unsurprisingly:

“It is no exaggeration to say that the fate of Europe’s gas integration project depends on France and Germany. Whatever the technical merits of the third package, the vision of an integrated competitive market will not be realised as long as these two governments fail to fully embrace it.”

History Repeating – Russia and the Caribbean Basin

October 18, 2008(By EDO, via Caracas Chronicles)

I had a Russian-Ukrainian colleague in my previous job in the UK. She loved dancing salsa, and spoke Spanish quasi fluently. She had never lived in a Spanish-speaking country, but learned dancing and the language in Kyiv, with Latin American students who had come over to the Soviet Union for their higher education. I am Central America-born. The Latin connection made it easier for us to get along and our colleagues wonder at our exoticisms. During a trip to Moscow in 2006, I had a long coffee break with a Russian bank employee. He was trained as a military, but ended up a marketing and communications executive in one of Russia’s most successful commercial banks. The discussion ended, far away from business, with Cuba, where members of his military family had been – he was born too late to be able to benefit from such perks. And the Russian army today is nothing for well-born young men. The few Russians I have met struck me as being very well aware of Latin America.

All this to say what? Like Karl Marx, that history repeats itself: “the first time as tragedy, the second as farce”. Read the rest of this entry »

Berlin and Moscow – What kind of trade is going on there? (slight upd.)

October 3, 2008A chill in relations in August -September following the Georgian war, but as Europe is starting to turn on its heaters, back to business as usual in EU-Russian gas and business relations. France, and now Germany couldn’t wait much longer and rushed to patch up their strained relations with Moscow. News today:

FT announcement: big deal between Germany’s EON and Russia’s Gazprom. Gazprom even renounced access to downstream assets in Germany. FT reports:

“Significantly, the deal saw Gazprom drop demands for participation in distribution assets in Germany – a cornerstone of Russia’s call for reciprocity in granting direct access for European companies to its vast energy reserves. “

BNE reports today:

Merkel says Georgia and Ukraine not ready for NATO MAP

bne

October 3, 2008German Chancellor Angela Merkel has said Germany still does not believe Ukraine and Georgia are ready to join NATO’s Membership Action Plan (MAP).

“As far as a specific step – MAP – is concerned, Germany’s position has been that the time has not yet come to grant it,” Interfax cites Merkel as saying at a joint news conference with Russian President Dmitry Medvedev.

Merkel said “the position has not changed” since April’s Bucharest NATO summit.

Hadn’t Merkel said something about Georgia’s place in NATO, back in August?

Russia seems to be valuing control of its former empire over Gazprom assets in Europe’s biggest gas market, which is Germany. Watch that space.

UPDATE a few minutes after publishing this post: And it looks like Russia isn’t exactly hurrying up to withdraw its troops from Georgia, as had been agreed with Sarkozy (courtesy Robert Amsterdam)

Schumpeterian analysis of Russia’s assertiveness in international relations

September 22, 2008Vladimir Putin and Oleg Deripaska

Lenin, founder of the Soviet Empire, is famous for many things, but among other for his book published in 1916 Imperialism, the Highest State of Capitalism. Joseph Schumpeter’s response in an essay on the Sociology of Imperialism published in 1919 retorted that imperialism is the result of excessive statism forged by pre-capitalist forces (the military, agrarian interests. etc), not capitalism. The state, in a sense, instrumentalises capitalists for its aims. Who was right? These theories can be tested in the case of today’s Russia. Read the rest of this entry »